You face a lot of challenges as a nonprofit accounting/finance professional. From sourcing revenue streams to staffing changes to preventing fraud, there are many different tasks that can prevent you from focusing on your mission.

Below we highlight just a few challenges nonprofit professionals are facing, and the opportunities they present to fine tune protocols and processes to make your day-to-day easier.

Challenges and Opportunities in Nonprofit Accounting

Fraud

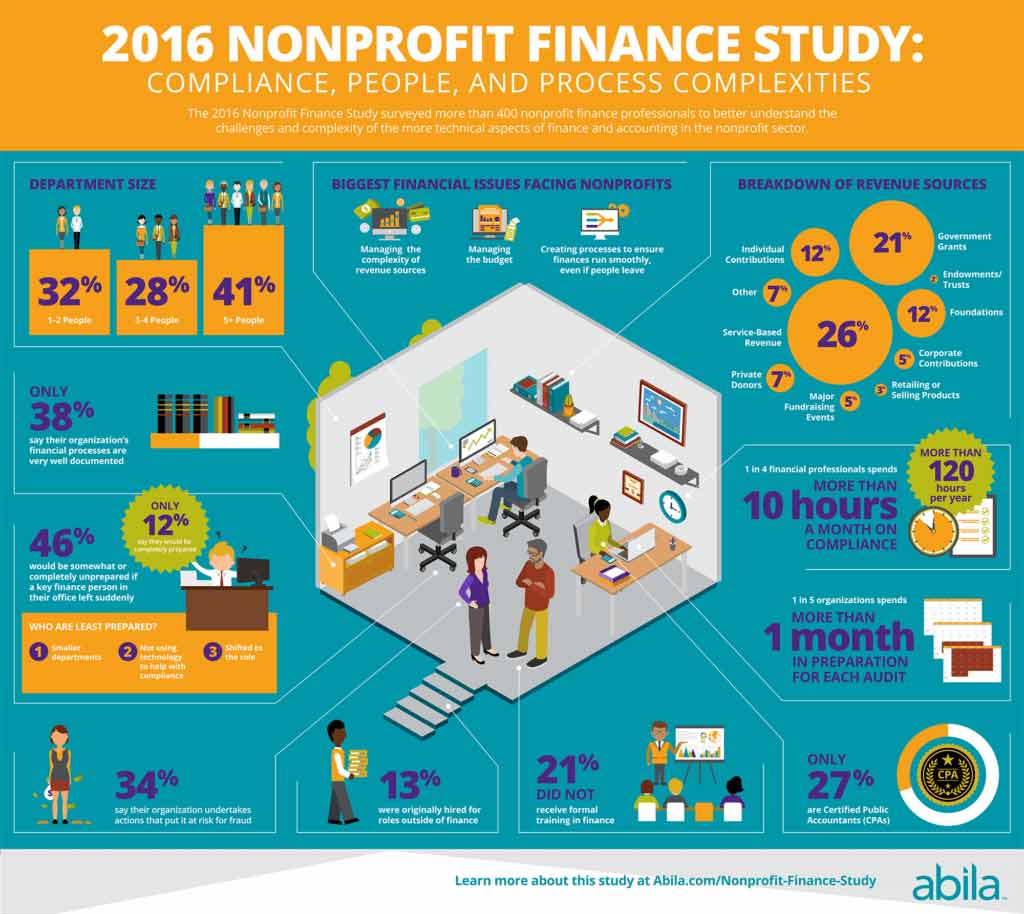

Fraud is one of the biggest concerns among nonprofit accounting and finance professionals. According to the 2016 Nonprofit Finance Study, nearly 95% of organizations take measures to prevent fraud. However, 35% say their organization “does things that put it at risk for fraud”.

What opportunities are there to increase your defenses against fraud?

- Teach employees the signs of fraud;

- Create a written Fraud Policy document;

- Hold unplanned audits;

- Stay organized!

Read How Nonprofit Accounting Software Can Help Prevent Fraud to learn more about fraud prevention.

Knowledgeable Staff

The same study also shed light on an organization’s ability to stay organized should key finance personnel leave. A whopping 88% of respondents said they were somewhat prepared to completely unprepared if they were to lose a key finance employee.

How can you prevent disorganization when there’s employee turnover or staff changes?

- Have written processes, procedures, and policies to make it easier for people to help out when you’re understaffed;

- Have a plan in place to promote and train employees to take on additional responsibilities;

- Provide educational opportunities for your staff so they’ll be more adept at stepping in when needed.

More Complexity in Nonprofit Finance

—

Capital Business Solutions is a financial and fundraising software provider for nonprofit organizations. Contact us today to learn how we can help you with your mission.