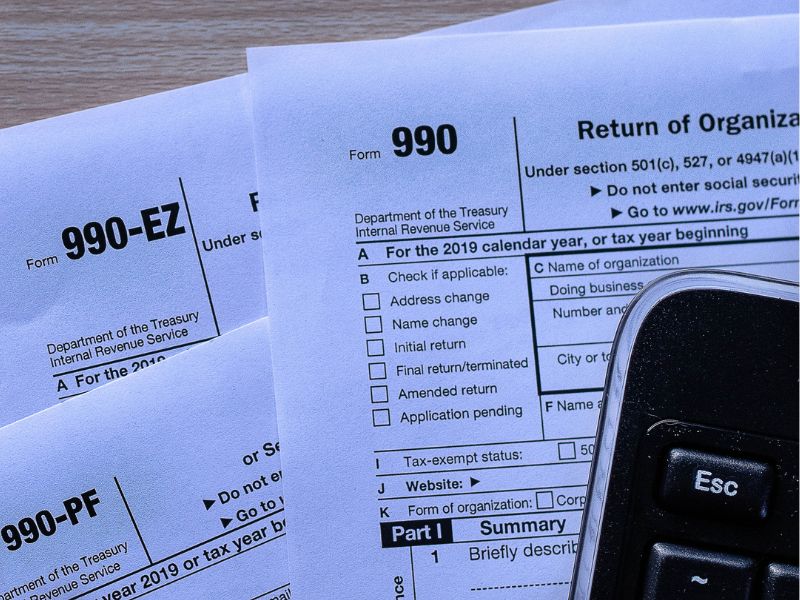

For tax-exempt organizations, filing a Form 990 is essential for maintaining compliance and demonstrating transparency to donors, watchdogs, and the IRS. Even though nonprofits don’t submit a traditional income tax return, they are generally required to file this annual information return to report governance, revenue, expenses, and program accomplishments.

Join our nonprofit financial consulting team as we explore how to file a form 990 for nonprofits and how nonprofit financial software can streamline the reporting process.

What Is Form 990 for Nonprofits?

Form 990 is the annual informational return submitted by tax-exempt organizations, charitable trusts, and certain political nonprofits. It captures key financial, operational, and governance data needed to maintain tax-exempt status.

The IRS requires detailed reporting on:

- Voting members of the governing body

- Total employees and volunteers

- Revenue from contributions, program service, and investments

- Expenses including benefits, salaries, and fundraising costs

- Total assets, liabilities, and fund balances

Mission and Program Reporting

In addition to financial metrics, nonprofits must disclose:

- The organization’s mission and key accomplishments

- Updates to program service offerings

- Grants or allocations provided to organizations or individuals

Compliance and Oversight Sections

The checklist portion includes yes/no questions related to:

- Governance policies

- Key employees and directors

- Revenue and expense statements

- Balance sheet reporting

Form 990 is also public, meaning donors, grantmakers, and researchers can view it to learn more about your organization.

Deadline for Filing Form 990

Most nonprofits must file by the 15th day of the fifth month after the end of their fiscal year. For example, a fiscal year ending March 31 results in an August 15 due date.

Who Is Required to File Form 990?

Not every tax-exempt organization files the same version of the form, and some groups are exempt entirely.

Organizations exempt from filing form 990 include:

- Faith-based organizations such as churches, missions, or parochial schools

- Subsidiaries of larger nonprofits when covered by a group return

- Government corporations

- Essential state bodies

Using Nonprofit Financial Software to Prepare Your Form 990

Accurate, organized financial data is essential when preparing Form 990. Modern nonprofit financial software makes this significantly easier by streamlining recordkeeping and reporting.

Financial accounting platforms designed for nonprofits allow users to track:

- Payroll and HR

- Grant management

- Donations and fundraising

- Functional expenses

- Program outputs and allocations

These tools also support stronger audit readiness and make it easier to read nonprofit financial statements by producing FASB-compliant or GASB-compliant documentation.

How Financial Edge NXT Supports Your 990 Filing

Accurate, well-organized financial data is essential for completing Form 990, and Financial Edge NXT provides the structure nonprofits need to simplify the process. As a cloud-based fund accounting system built specifically for the nonprofit sector, Blackbaud’s Financial Edge NXT helps organizations maintain consistent financial categories, produce audit-ready statements, and streamline compliance reporting required by the IRS.

A trusted nonprofit financial software solution, Financial Edge NXT supports your annual Form 990 preparation by offering:

- Automated reporting features that pull complete financial data directly into clean, consistent outputs

- Clear audit trails that make it easy to verify entries and demonstrate accountability

- A chart of accounts structure aligned to nonprofit accounting standards and IRS reporting categories

- Real-time visibility into revenue, expenses, grants, programs, and allocations needed for Form 990 disclosures

These tools reduce manual work and help teams avoid common filing errors, giving organizations stronger confidence in their compliance efforts.

Enhance Nonprofit Support with Financial Edge NXT Consulting

Many nonprofits maximize the benefits of their financial software through Financial Edge NXT training and support services offered by Capital Business Solutions. Our nonprofit financial consulting team helps organizations refine workflows, customize reporting, and optimize the chart of accounts for annual Form 990 requirements.

Financial Edge NXT training can also address system configuration, internal controls, and best practices for capturing data throughout the year. For teams responsible for preparing financial statements and IRS filings, Financial Edge NXT consulting ensures staff understand how to use the platform efficiently and accurately.

Training may include:

- How to run the reports needed for Form 990

- Best practices for grant, fund, and functional expense tracking

- Step-by-step guidance for managing year-end closing tasks

- Ways to improve data accuracy and reduce manual adjustments

In addition to implementing the use of nonprofit financial software, many organizations partner with ongoing nonprofit financial consulting services to keep systems running smoothly and ensure compliance with evolving reporting standards. Together, these services help streamline financial operations and improve the ease and accuracy of filing Form 990 each year.

Filing Form 990 FAQs

Do all nonprofits need to file Form 990?

Most do, but some religious organizations and government units are exempt.

How to file Form 990-EZ electronically for nonprofits?

Nonprofits can file Form 990-EZ electronically using any IRS-authorized e-file provider. Gather your financial statements, program details, and governance information, then complete and review the return before submitting it through the e-file system.

How many years back can you amend a Form 990?

You can generally amend a Form 990 for up to three years after the original filing date. Submit the amended return with corrected information and a clear explanation of what changed and why.

How to find a Form 990 for a nonprofit organization?

Because Form 990 is public, you can find it through the IRS Tax-Exempt Organization Search.

What happens if a nonprofit misses the filing deadline?

Late filings may result in penalties, and missing three consecutive filings may lead to automatic revocation of tax-exempt status.

Can nonprofit financial software help reduce filing errors?

Yes. Nonprofit financial software like Financial Edge NXT reduces manual entry and improves accuracy by keeping financial data organized throughout the year.

What Is Financial Edge NXT Consulting for nonprofits?

Financial Edge NXT training teaches nonprofit finance teams how to use the software to manage day-to-day accounting, produce compliant reports, and prepare financial data for Form 990. Training typically covers system navigation, report generation, budgeting tools, grant tracking, and best practices for maintaining a clean chart of accounts.

Discover the Right Nonprofit Financial Software for Stress-Free Form 990 Preparation

If your team wants to streamline data collection and improve the accuracy of your annual Form 990, the right tools and training make all the difference. Capital Business Solutions helps nonprofits select, implement, and optimize powerful platforms like Financial Edge NXT through comprehensive Financial Edge NXT consulting, system configuration, and staff training.

To learn how we can support your organization’s financial reporting, call us today at (888) 249-6008 or fill out our contact form or reach out to our team today.

Contact Form

We would love to hear from you! Please fill out this form and we will get back to you shortly.