No matter what stage your nonprofit is in—whether you’ve just opened your doors with a handful of people, you’re growing quickly, or you’re an established, stable organization with several departments, staying on top of your accounting and bookkeeping is essential to your continued growth and success.

Table of Contents

Why Choose Capital Business Solutions’ Nonprofit Accounting Software?

How to Choose the Right Nonprofit Accounting Software from Capital Business Solutions

Best Nonprofit Accounting Software Solutions [2025]

Nonprofit accounting and bookkeeping is not an easy or fast task, but the success and stability of your organization rely on knowing where your money is coming from, where it’s going, and how much there is. When you’re trying to balance donations, grants, and other forms of revenue with outgoing expenses, manage specific funds, and keep accurate records, it can get overwhelming quickly, especially if you don’t have the proper tools to help you keep up.

Having the right nonprofit accounting software is key to saving time, reducing stress, and improving the accuracy and effectiveness of your nonprofit accounting and bookkeeping practices. To help you determine the right option for your nonprofit organization, we’re sharing some of the leading software solutions and integration tools so your team can compare features, understand tradeoffs, and choose a setup that scales, supports nonprofit-specific reporting, and fits your budget.

Why Choose Capital Business Solutions’ Nonprofit Accounting Software?

While nonprofits need traditional features in their accounting software, like having areas to log accounts payable, forecast revenue and spending, and maintain payroll, organizations also need features that are specific to nonprofits. This includes a way to accept and record donations and manage funds, grants, and trust.

Accounting software designed with nonprofit reporting needs in mind makes it easier for organizations to maintain compliance. That’s why we are providing nonprofits with fund accounting software options specifically designed for nonprofit organizations or software solutions that offer specific features necessary for NPOs. The options below often feature tools specific to the needs of an nonprofit organizations, including essential tools to accept and record donations, manage grants and trusts, and maintain compliance.

How to Choose the Right Nonprofit Accounting Software from Capital Business Solutions

Before choosing your fund accounting software and support apps like PowerCloud, it’s important to know exactly what you need and how to get the most out of it. Consider making a list of the following factors and compare your list with the overviews of your option:

- Scalable – As your organization grows, is the software able to keep up with your growth or will you need to replace it with a different platform in a few years?

- Size – Will you need a robust solution designed specifically for large organizations or, if you’re a small or local NPO, will a lighter option work best?

- Features – Think about your “must-haves” and make sure you aren’t sacrificing them in favor of features you may not need.

- Price – How much can you comfortably afford to spend? Also, is it a one-time fee, monthly, or annual fee?

- Nonprofit specific reporting within the system – Look for native fund accounting reports (by fund, program, grant, and donor restriction) with functional vs. natural expense views, allocations, and drill-downs—so board/audit needs are met without exporting.

It’s important to note that many fund accounting software options offer tiered levels, like basic, standard, and premier which may affect the available features for your budget.

Best Nonprofit Accounting Software Solutions [2025]

The software solutions in this guide include features designed for a variety of nonprofit organizations’ needs, including mission-critical practices for charities, schools, and churches.

1. Blackbaud Financial Edge NXT

Built for complex nonprofits and public sector teams, Financial Edge NXT streamlines multi-fund, multi-department accounting while strengthening audit readiness. Beyond core ledgers, it adds automation (AP, payments, bank/credit card feeds) and emerging AI-assisted workflows to cut manual entry, surface exceptions, and speed closes. Granular, role-based controls and compliance features improve transparency without adding clicks—so finance can move faster and stay accountable.

Features include:

- General ledger

- Accounts payable/receivable

- Activity tracking

- Asset management

- Grant management and tracking

- Bank reconciliation

- Budgeting and forecasting

- Compliance management

- Partnership accounting

- Fundraising support

- Sub-fund Accounting

- Native Automated Payments

- Bank/Credit Card Feeds

- Native Expense Management

- Role-base Security

- Concurrent and View-only User Licenses

Best for: Large, multi-department nonprofit organizations who need comprehensive accounting software.

Free Trial: N/A

Demo: Register to schedule your product tour.

2. Accounting Suite by AccuFund

Accounting Suite by AccuFund offers a comprehensive accounting solution for both nonprofits and government agencies. Providing both on-premise and cloud-based deployment options, you can use this anywhere, and it offers a wide variety of features along with robust reporting capabilities.

Core features include:

- General ledger

- Accounts payable

- Financial reporting

- Bill payment and tracking

- Managing cash receipts

- Bank reconciliation

Optional features include:

- Accounts receivable

- Fixed assets tracking

- Requisitions

- Grants management

- Position control

- Loan tracking

- Client invoicing

- Allocation management

- Payroll suite

- Budget and forecasting

- Client accounting

Best for: Government agencies and nonprofits who need a flexible, yet comprehensive solution.

Free Trial: N/A

Register to watch a free demo!

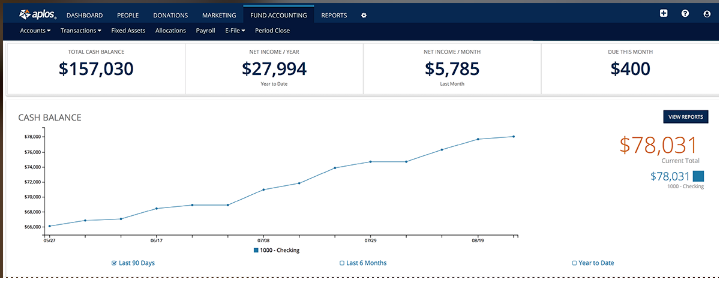

3. Aplos

Designed for smaller NPOs, school organizations, and churches, Aplos is easy to use and streamlines how you can track donations and gifts. This cloud-based system allows organizations to manage fund accounting and finances and track cash flow while integrating online donation tools, donor database reports, and event registration. This is an all-in-one solution for many organizations.

Core features include:

- General ledger

- Accounts payable and receivable

- Activity tracking

- Asset management

- Bank reconciliation

- Budgeting

- Donor and donation management

- Financial statements and reporting

Advanced Features include:

- Fundraising reporting

- Form 990 reporting

Best for: Small nonprofit organizations and churches who need a simple, user-friendly accounting solution you can access anywhere.

Free Trial: Yes, you can access a free 15-Day trial.

Register to watch a free demo!

4. MIP Fund Accounting

MIP Fund Accounting (formerly Abila MIP Fund Accounting) is ideal for all sizes of organizations who need scalable software that’s easy to customize. MIP is supported both on-premise and through a cloud-based platform, plus there’s a mobile app so you can keep up easily.

This nonprofit accounting software offers the following core features:

- General ledger

- Accounts payable/receivable

- Bank reconciliation

- Budgeting and forecasting

- Reporting

Optional features include:

- Payroll

- Timekeeping

- Human resources

- Grant management

- Allocation management

- Fixed assets

- Multi-currency tracking

Best for: Small, medium, and large nonprofits who need accounting software that grows with them.

Free Trial: N/A

Register to schedule a personalized, 30-minute demo!

5. Fastfund Nonprofit Accounting Software

Fastfund Nonprofit Accounting Software is a cloud-based software for small to medium nonprofits and small government agencies. This is specifically designed for fund accounting to ensure accountability and maintenance related to funding specific goals or sources, and it saves time through seamless integration with your accounts payable, cost allocations, fundraising, and payroll.

Core features include:

- General ledger

- FASB compliant statements

- Bank reconciliation

- Cash receipts and disbursements

- Asset management

- Donor management

- Budgeting and forecasting

Optional features:

- Accounts payable/receivable

- Cost allocations

- Fundraising management

- Volunteer management

- Donation processing

- Campaign management

- Payroll

Best for: Small and medium-sized nonprofit organizations and churches

Free trial: Yes, contact for length of trial

Demo: Connect to an online, 60-minute demo

6. FUND E-Z

FUND E-Z is a fund accounting software option for nonprofits that is easy to use while providing a variety of core features and improves risk mitigation. FUND EZ allows users to create and track all types of budgets, segmenting them into projects, grants, and campaigns as needed, while automatic backups and crash protection prevent a loss of essential data.

Core features include:

- General ledger

- Bank reconciliation

- Budgeting

- Accounts payable/receivable

- Security

- Direct cost allocations

Optional features include:

- Fundraising management

- Donor management

- Custom reporting

- Indirect Cost allocation

- Purchasing and encumbrance

Best for: Large, complex, or multi-department nonprofit organizations

Free trial: 30-day trial

Demo: Contact for a demo

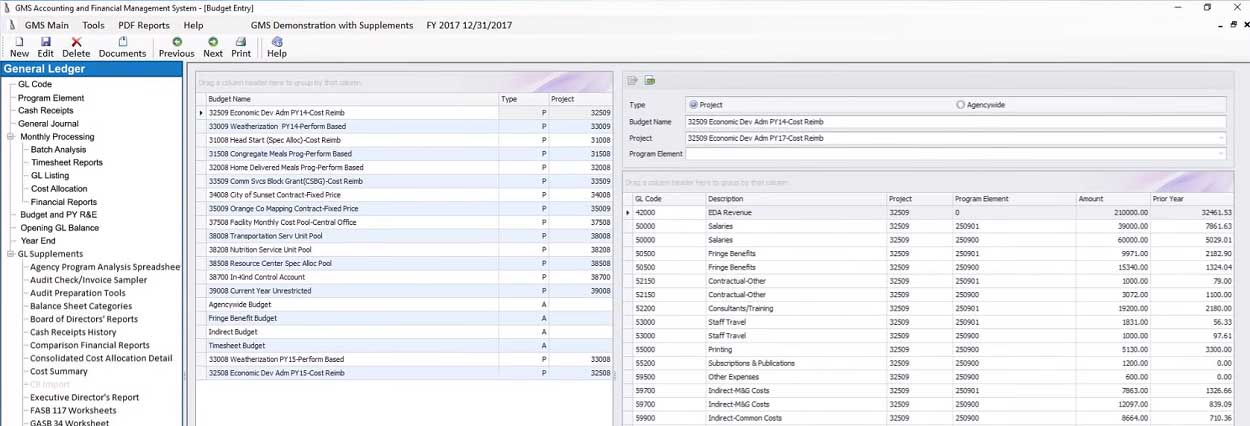

7. GMS Accounting and Financial Management/Reporting System

Designed for nonprofit and public organizations who rely on grants and contracts, GMS Accounting and Financial Management/Reporting System is a bit different than the fund accounting management software programs listed. It is designed for activity accounting and written specifically for grants, contracts, and activities tracking and reporting. While the basic accounting package is indeed basic, there are all types of add-ons to provide a custom experience.

Core features include:

- General ledger

- Cash receipts

- Budgeting for multiple grants and contracts

- Processing

- Cost allocation

- Compliance management

- Grant management and tracking

- Bank reconciliation

Additional features include:

- Purchase orders

- Accounts payable/receivable

- Billing and invoicing

- Payroll

- Time processing

- Direct deposits

- Security features

Best for: Nonprofit and public organizations of all sizes who rely on grants and contracts rather than needing fund accounting

Free trial: N/A

Demo: Register for a 60-minute, personalized demo.

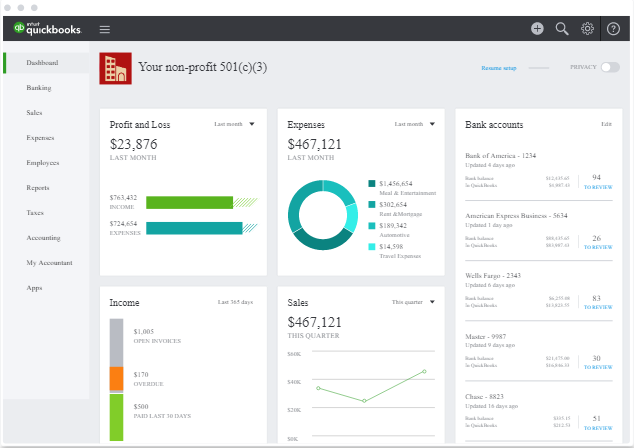

8. Intuit QuickBooks Non-Profit

QuickBooks is one of the best-known names in accounting and bookkeeping software, known for being efficient and ideal for customization. While not known for its non-profit capabilities, it is an option under “industries” for set-up and has some available features primarily used by NPOs.

Features include:

- General ledger

- Customized reporting

- Fixed asset management

- Bank reconciliation

- Billing and invoicing

- Accounts payable/receivable

- Grant management

- Donation management

- Payroll

Best for: Small organizations seeking customization and ease of use

Free Trial: Yes, a 30-Day trial

Demo: N/A

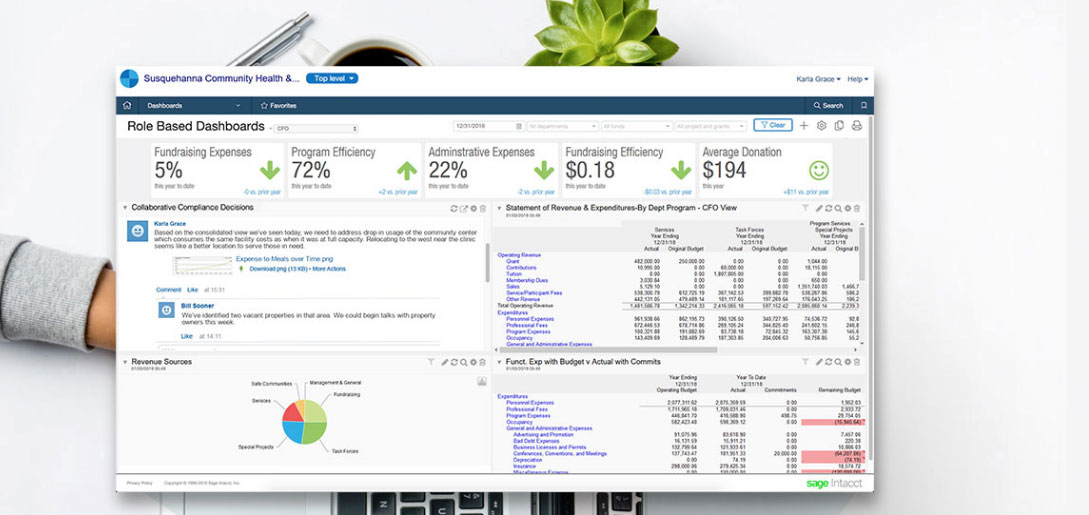

9. Sage Intacct

Sage Intacct is a leading nonprofit accounting software solution that offers an open API structure, making it easy to integrate your accounting software with Salesforce or your payroll software. While its core features are often more than adequate for most nonprofit organization’s accounting needs, there are additional modules available so you can customize it to your preference while its intuitive interface makes it easy to navigate.

Core features include:

- General ledger

- Accounts payable/receivable

- Cash management

- Order management

- Reporting

- Budgeting and forecasting

Best for: Small to mid-size nonprofit organizations who want an easy-to-use system that integrates into other software platforms.

Free trial: 30-Day free trial

10. ShelbyNext Financials

ShelbyNext Financials is cloud-based accounting software that is designed specifically for churches of all sizes. This is just one software platform for churches offered by Shelby and other products can be bundled for full church management software solutions.

Core features include:

- General ledger

- Accounts payable/receivable

- Fixed assets

- Bank reconciliation

- Payroll

- Purchasing management

Best for: Small to large churches needing nonprofit accounting software that goes beyond just the basic functionality.

Free trial: N/A

11. Xero for Nonprofits

Xero for Nonprofits is an affordable nonprofit accounting software solution that integrates with over 500 third-party apps, such as CRM software, Infoodle, Google Suite, and payment gateways like Square and Stripe. With an extensive list of features and an easy-to-use, intuitive interface that works well for beginners and less experienced bookkeepers and accountants, Xero saves time and increases efficiency.

Core features include:

- General ledger

- Accounts payable/receivable

- Bank reconciliation

- Invoicing

- Inventory

- Payroll

- Fixed asset management

- Expense tracking

Best for: Small to medium nonprofits who want an inexpensive, scalable software option.

Free trial: 30-day trial

Request a demo!

Integration Tools to Enhance Nonprofit Accounting Software

There are also several software solutions available that enhance your nonprofit’s accounting, streamline your processes, and improve your overall experiences. While they don’t offer the comprehensive accounting features as the solutions listed above, these support options can help you with forecasting, budgeting, and additional ways to improve the financial side of your nonprofit’s goals.

1. Power Cloud Reporting for Financial Edge NXT

Power Cloud Reporting extends your Financial Edge NXT reporting with a familiar Excel experience—so you can build cleaner board packets, consolidate data across databases, and drill into transactions without extra complexity or rework. It’s designed to keep FE NXT as your source of truth while giving finance and program leaders flexible, self-serve reports.

Core features include:

- Embedded Excel drill-down to transactions, accounts, projects, budgets, and supporting docs

- Statistical reporting and budget vs. actuals

- Consolidation across multiple FE databases

- Advanced filtering plus Excel formatting/formulas for tailored layouts

- Security to restrict access by report, layout, segment/project

- Income statements by fund, department, or project on separate sheets

Best for: Nonprofits that want advanced, Excel-based reporting on top of FE NXT—especially teams managing multiple databases or complex departmental reporting.

Free trial: N/A

Register for an upcoming webcast!

2. Effort Track for Financial Edge NXT

Effort Track brings integrated time sheets and time budgeting into FE NXT—tying hours, wages, leave, and benefits directly to grants, programs, and segments. With flexible approvals and automated journal entries, it reduces spreadsheet work and strengthens compliance and budget enforcement.

Core features include:

- Native FE NXT general ledger integration

- Timesheet tracking to any segment/combination in your chart of accounts

- Approval routing with up to five levels

- Leave tracking and enforcement

- Allocation engine for wages/leave/benefits by hours or fixed percentages

- Budget rules/scenarios and enforcement by employee, pay period, calendar year, or grant period

- Department-level GL access controls

- Automated journal entry creation to FE NXT

Best for: Nonprofits that need grant- and program-ready time entry with strong approvals, allocations, and budget controls inside FE NXT.

Free trial: N/A

Contact our team for a walkthrough!

3. Adaptive Insights

Adaptive Insights makes it easy to improve your accounting by helping you successfully forecast, budget, and maintain accounting. This web-based software is ideal for medium to large organizations who already have accounting software but want to integrate more advanced planning, tracking, and forecasting.

Core features include:

- Advanced reporting

- Financial statements

- Balance sheets

- Budgeting

- Forecasting

- Integration with core accounting programs, including Financial Edge NXT and Sage Intacct

Best for: Medium to large nonprofit organizations who need an advanced financial planning tool.

Free trial: Yes, register to request a free trial

Register here for a free online demo!

4. Breeze Church Management Software

For churches who use QuickBooks Online for their accounting needs including invoicing, general ledger functionality, and budgeting, Breeze is an excellent way to integrate nonprofit-specific features, including donation management, online giving, pledges, and reporting. Additionally, this is an all-in-one cloud-based platform that allows churches to operate children’s ministry check-in and maintain contacts, volunteers, and directories all in one place while still offering an affordable price with an easy-to-use interface.

Core features include:

- QuickBooks Online integration

- Donation management

- Pledges

- Online giving

- Contribution reporting

- Year-end statements

- Volunteer management

- Event management

Best for: Small to medium-sized churches who already use QuickBooks Online for their general accounting needs.

Free trial: N/A

Watch an instant demo here!

5. Infoodle

Infoodle acts as a hub to manage the community aspects of your nonprofit organization. For organizations that use Xero, you can integrate donor information, bank accounts, and invoice payments into Infoodle so you can more accurately target your donors. Additionally, Infoodle makes it easy to centralize your contacts, create receipts for your donors, improve communications, and organize events with ease on one cloud-based platform.

Core features include:

- Manage your documents, equipment, and resources

- Event management

- Donor and registration capture

- Donor management

- Financial tracking

- Centralized contacts and communications

Best for: Churches, nonprofits, and community groups who want to leverage their accounting software and streamline their communications.

Free Trial: Yes, 14-day free trial

6. MartusTools

For robust budgeting, so you can drill down the transactional level details of your nonprofit organization, consider MartusTools™. This cloud-based budgeting tool integrates easily with Financial Edge NXT, Sage Intacct, and QuickBooks, so you can quickly import essential information and make an accurate budget. Additionally, it has built-in templates to improve your reporting that you can then customize to meet your needs.

Core features include:

- Budget worksheets

- Reporting templates

- Transactional level details

- Simple accounting integration

Best for: Nonprofit organizations who need a more robust budgeting program beyond an Excel spreadsheet or a simple template.

Free trial: N/A

7. Sumac

Sumac is a CRM tool designed for nonprofits that integrates into your nonprofit’s website, along with QuickBooks and Xero, allowing you to convert transactions into entries that can be imported to your accounting ledger with a click. Using Sumac, you can process payments, batch your donations, and create invoices, all with the basic CRM platform and reflect these actions in your accounting program.

Core features include:

- Contact management

- Custom reporting

- Payment processing

- Donation management

- Invoices with payment schedules

- Accounting integration

- Event management

- Time tracking

Additional features include:

- Memberships

- Volunteers

- Grant management

- Pledge management

- Forms

- Proposals

Best for: Small to medium organizations that are using QuickBooks or Xero nonprofit accounting software who want to streamline and customize their CRM.

Free Trial: N/A

Learn More About Choosing the Best Nonprofit Accounting Software

Your nonprofit accounting software is one of your most valuable tools, so it’s not a decision to take lightly. That’s why we work with nonprofit organizations nationwide to help them learn more about their options and make the best choice for their organization.

To learn more about nonprofit software solutions, reach out to our team at Capital Business Solutions at 888-249-6008 or fill out our contact form to get started!